Calculating the break-even point is essential for small businesses to determine their profitability. The break-even point is the point at which a business’s revenue equals its costs, indicating that it has reached a state of financial stability. To calculate the break-even point, you need to know your fixed costs and the contribution margin.

Fixed costs are costs that do not change regardless of the number of units sold, such as rent and utilities. The contribution margin is the difference between the selling price per unit and the variable costs per unit, representing the amount of revenue left over after covering variable costs. There are two formulas for calculating the break-even point: one based on the number of units sold and the other based on sales in GBP.

By using these formulas, businesses can determine their break-even point and make informed decisions about pricing, costs, and profitability.

In the next section, we will explore what the break-even point is in business and how it can help assess financial health and profitability.

What is the Break Even Point in Business?

The break-even point in business is a crucial metric that determines the stage at which a business’s revenue equals its costs, resulting in neither a profit nor a loss. It serves as an indicator of financial stability and helps businesses assess their profitability.

To calculate the break-even point, businesses can use the break-even formula. This formula divides the fixed costs by the contribution margin. Fixed costs are the expenses that remain constant regardless of the number of units sold, such as rent and utilities. The contribution margin, on the other hand, is the difference between the selling price per unit and the variable costs per unit, representing the amount of revenue left over after covering variable costs.

By knowing their break-even point, businesses can make informed decisions about pricing, costs, and revenues to achieve profitability. It helps them set realistic goals and evaluate the financial health of their operations. Additionally, understanding the break-even point enables businesses to identify areas where costs can be reduced and optimize their pricing strategy.

Here is an example of the break-even formula:

| Break-Even Formula |

|---|

| Break-Even Point (in units) = Fixed Costs / (Selling Price per Unit – Variable Costs per Unit) |

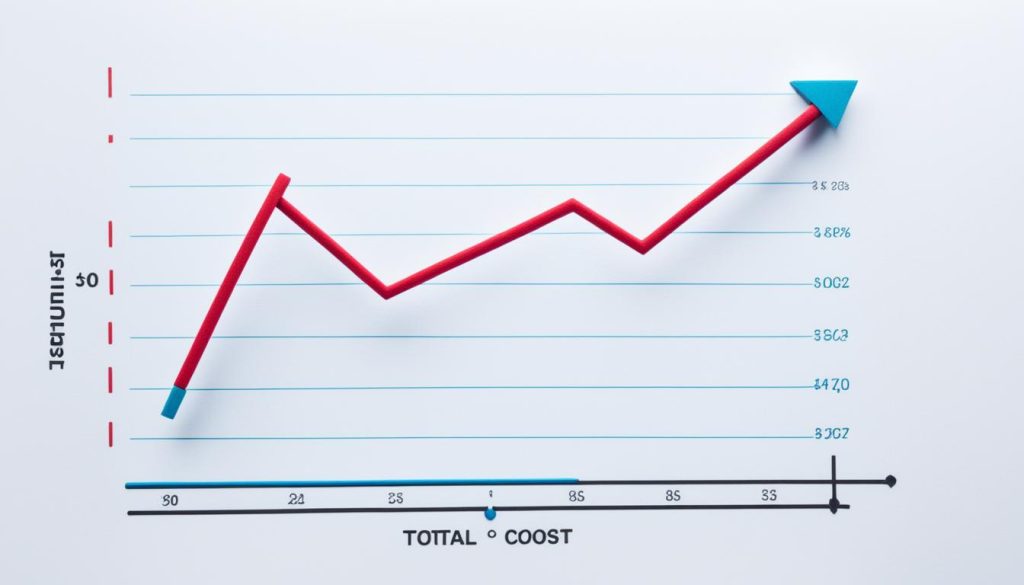

As illustrated in the break-even graph above, the break-even point is where the total revenue and total costs intersect. It indicates the minimum level of sales required for a business to cover its costs.

Knowing the break-even point is essential for businesses as it helps them set realistic targets, manage expenses, and make strategic decisions. By achieving a break-even point, businesses can work towards profitability and long-term success.

How to Calculate the Break Even Point?

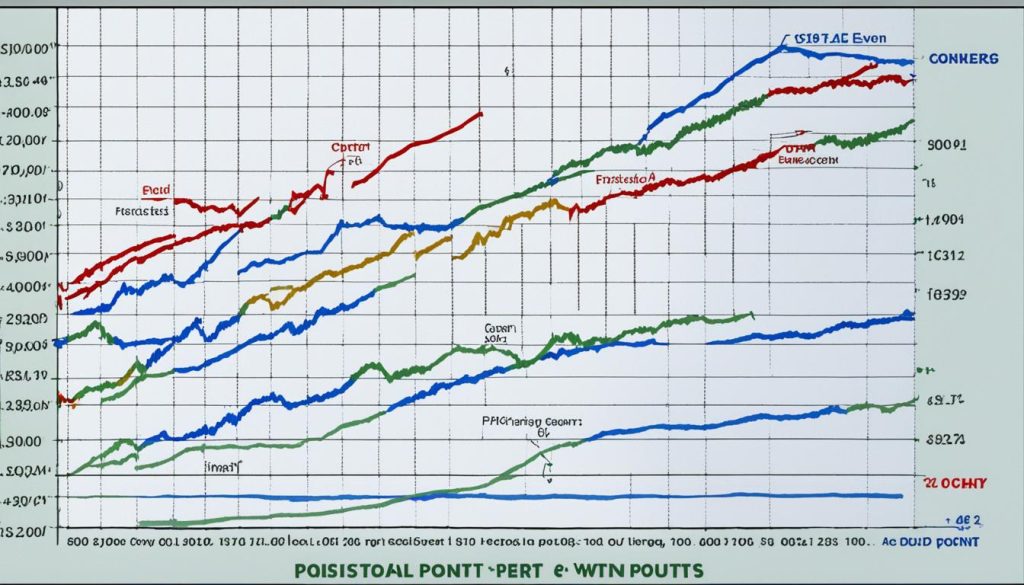

Calculating the break-even point for a business involves using two different formulas. These formulas provide valuable insights into the financial stability and profitability of a business. Let’s explore each formula in detail:

Formula 1: Break-Even Point Based on Units Sold

To calculate the break-even point based on units sold, use the following formula:

| Formula | Description |

|---|---|

| Break-Even Point (in units) = Fixed Costs / (Revenue per Unit – Variable Cost per Unit) | This formula divides the fixed costs by the difference between the revenue per unit and the variable cost per unit. |

Formula 2: Break-Even Point Based on Sales in GBP

To calculate the break-even point based on sales in GBP, use the following formula:

| Formula | Description |

|---|---|

| Break-Even Point (in GBP) = Fixed Costs / Contribution Margin | This formula divides the fixed costs by the contribution margin. The contribution margin is the difference between the selling price per unit and the variable costs per unit. |

By using these formulas, businesses can determine their break-even point accurately. Whether you want to calculate the break-even point based on units sold or sales in GBP, these formulas provide the necessary insights for making informed decisions about pricing and costs.

How to Use a Break Even Analysis?

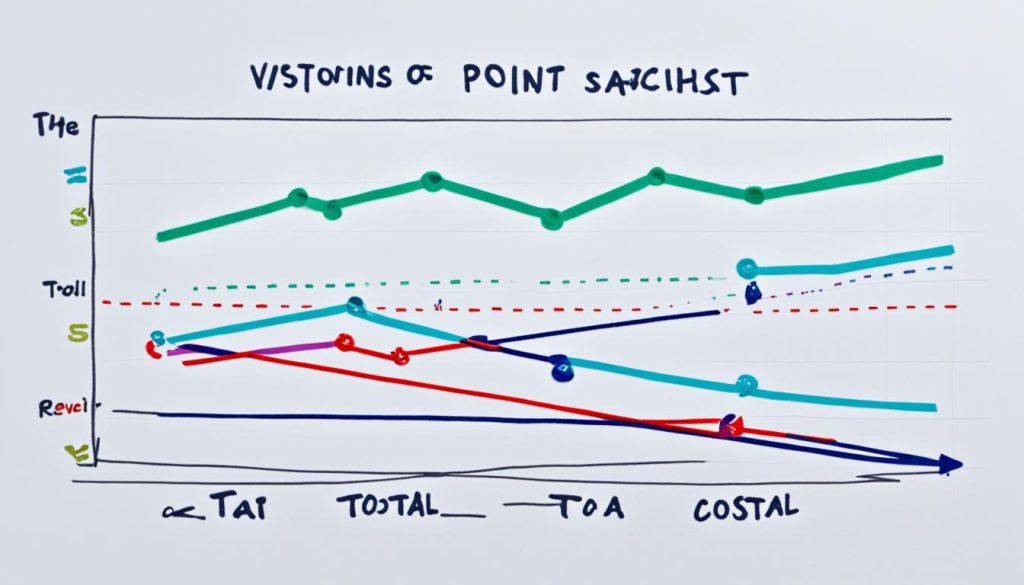

A break-even analysis is a valuable tool that businesses can use to assess their financial situation and make strategic decisions. It provides insights into the break-even point and helps businesses determine whether their current plan is realistic or if they need to make adjustments. By conducting a break-even analysis, businesses can evaluate their pricing structure, identify areas where costs can be reduced, and set realistic goals for profitability.

One way to improve your break-even point is by analyzing your pricing structure. By understanding the relationship between your product’s price, variable costs, and fixed costs, you can determine the optimal pricing strategy to reach your break-even point more quickly. For example, if you increase the price of your product while keeping your costs constant, you can improve your break-even point by increasing your profit margin per unit sold.

To calculate the break-even point and assess its impact on your business, it’s essential to use a breakeven point example. This example will allow you to see how changes in pricing, costs, or sales volume affect your break-even point. By running different scenarios and analyzing the results, you can make informed decisions about your business’s future.

Now let’s discuss the formula for break-even point in a level business. The break-even point formula is calculated by dividing the fixed costs by the contribution margin. The fixed costs represent your business’s total expenses that do not change regardless of the number of units sold. The contribution margin is the difference between your selling price per unit and the variable costs per unit. This formula helps you determine how many units or sales revenue you need to cover your expenses and break even.

While the break-even point formula may seem straightforward, students often wonder how to calculate break-even point in GCSE business. In GCSE business, you calculate the break-even point by dividing the fixed costs by the selling price minus the variable costs per unit. This formula adheres to the principles taught in GCSE business courses and provides a clear method for calculating the break-even point.

In business GCSE, break-even refers to the stage where a company’s revenue exactly matches its costs, resulting in no profit or loss. It is a key concept that students learn in GCSE business as it helps them understand the financial health of a business and its profitability potential.

Furthermore, calculating profit in GCSE business is an essential part of understanding the financial performance of a business. Profit is calculated by subtracting the total costs, including fixed and variable costs, from the total revenue. By calculating profit, GCSE business students can evaluate the profitability of different business ventures and analyze the financial health of a company.

A break-even analysis can also be used as a comprehensive tool for securing funding for your business. By presenting your break-even point and demonstrating a solid understanding of your pricing, costs, and revenue, you can prove to potential investors that your business is financially stable and has a high potential for profitability.

Moreover, a break-even analysis can serve as a motivational tool for both business owners and their teams. By setting realistic break-even goals, you can create a roadmap for success, track progress, and celebrate milestones along the way. This visualization of the break-even point can inspire and motivate everyone involved in the business to work towards achieving profitability.

Break-Even Analysis Example

| Selling Price per Unit | Variable Cost per Unit | Fixed Costs | Contribution Margin | Break-Even Point (Units) |

|---|---|---|---|---|

| £10 | £5 | £10,000 | £5 | 2,000 units |

| £15 | £7 | £15,000 | £8 | 1,875 units |

| £20 | £10 | £18,000 | £10 | 1,800 units |

In the example table above, we can see how different selling prices, variable costs, and fixed costs impact the break-even point. By analyzing such a table, businesses can make informed decisions about pricing, costs, and revenues to achieve profitability.

Limitations of Break Even Point Analysis

While the break-even point analysis is a valuable tool for businesses, it is important to acknowledge its limitations. Understanding these limitations can help businesses make more informed decisions and avoid potential pitfalls.

1. Assumption of Uniform Selling Price

The break-even point analysis assumes that a business will sell all its stock at the same price. However, in reality, businesses often face fluctuations in pricing due to factors such as competition, market demand, and promotional activities. This assumption can impact the accuracy of the break-even point calculation, especially when there are significant variations in selling prices.

2. Variable Costs’ Fluctuations

Variable costs, such as raw materials, direct labor, and utilities, can change regularly in response to various factors like market conditions and supplier pricing. These fluctuations can make the break-even analysis less accurate. Businesses need to be vigilant about monitoring and adjusting variable costs to ensure the reliability of the break-even point calculation.

3. Unrealistic Assumptions

- Businesses may sometimes make unrealistic calculations regarding the number of products sold and costs. These unrealistic assumptions can lead to inaccurate break-even calculations and misinformed decisions.

- Additionally, assumptions related to fixed costs, variable costs, and market demand need to be carefully evaluated to avoid false conclusions based on inaccurate data.

4. Negative Break-Even Point

In theory, a break-even point can be negative, indicating that a company’s operating expenses are higher than its sales income, resulting in a net loss. However, in practice, a negative break-even point is unsustainable, as a business cannot operate indefinitely at a loss. It is crucial for businesses to take corrective actions to improve their profitability and achieve a positive break-even point.

By considering these limitations, businesses can use the break-even point analysis as a guide rather than relying solely on its results. It is essential to evaluate the assumptions made and ensure that the analysis aligns with the specific characteristics and dynamics of the business.

Conclusion

The break-even point is a crucial metric for businesses to assess their financial health and determine their profitability. By calculating the break-even point, businesses can make informed decisions about pricing, costs, and revenues to achieve profitability. It provides valuable insights into the minimum amount of sales or units a business needs to cover its fixed and variable costs, ensuring that it has reached a state of financial stability.

However, it’s important to consider the limitations of the break-even point analysis. This analysis assumes that a business will sell all its stock at the same price, which may not always be the case in reality. Variable costs can also fluctuate, affecting the accuracy of the analysis. That’s why it is essential for businesses to use the break-even point as a guide rather than relying solely on its results.

Overall, understanding and utilizing the break-even point analysis can help businesses achieve financial stability and success. By evaluating their break-even point, businesses can adjust their pricing strategies, identify areas where costs can be reduced, and set realistic goals for profitability. It is a powerful tool that empowers businesses to make informed decisions and drive their financial success.